Global Auto Production Is Shifting Across Mexico, India, and Europe

The map of global carmaking is being quietly redrawn. Not with press releases or ribbon cuttings, but with factory schedules, supplier relocations, and new accents on the shop floor. Production that once clustered tightly in a few regions is stretching out, responding to labor costs, trade rules, and the slow churn of technology. Mexico, India, and Europe sit at the center of this shift, each for different reasons. Some moves feel sudden. Others have been years in the making.

Mexico’s Factory Belt Keeps Getting Longer

Walk through an auto plant in Guanajuato or Puebla, and you notice the rhythm first. Workers rotate through three shifts with tight takt times, and trucks constantly come and go toward the U.S. border. Mexico has become one of the world’s largest vehicle exporters, with data from the International Organization of Motor Vehicle Manufacturers (OICA) consistently placing it among the top producers globally.

Their proximity to the U.S. market keeps logistics straightforward, supported by a dense supplier network built over decades. Trade certainty under USMCA, which tightened regional content rules, has pushed automakers to source more parts locally.

There’s also the human side. While wages remain lower in Mexico than in the U.S. or Europe, the costs are rising fast enough that shifts in cost structures are already on the horizon.

India Is No Longer Just “The Future”

For years, India was discussed as a promising location for production. Now, it’s a reality. According to India’s Society of Indian Automobile Manufacturers, the country produces millions of vehicles annually, with strong growth in small cars, motorcycles, and increasingly, exports.

Factories outside Chennai or Pune feel different from Mexico’s. They’re not only newer but more vertically integrated. You’ll see suppliers sharing walls with assembly lines, and software teams upstairs debugging code for infotainment systems while engines are bolted together below. India’s strength isn’t only labor cost but the scale of its massive plants.

Global automakers are adjusting accordingly. Compact SUVs, entry-level EVs, and city cars once built in Japan or Europe now launch in India first, designed from the outset for traffic density, heat, and price sensitivity. Those design choices travel well.

Europe Is Rebuilding While Running

Europe’s auto industry isn’t shrinking so much as reshaping itself mid-stride. Germany, France, Spain, and Eastern Europe still build millions of vehicles each year, but the mix is changing with an emphasis on electric drivetrains and battery modules.

Data from the European Automobile Manufacturers’ Association shows internal combustion production declining while EV output rises sharply. The transition isn’t smooth. Legacy plants retrofit in fragments, often while still building older models—a welding line for one car here, a battery pack area bolted on behind it. Temporary fixes that quietly become semi-permanent.

Costs are now higher, energy prices are fluctuating, and regulations are evolving quickly. That said, Europe retains deep engineering talent and enjoys the benefit of being close to premium markets.

Supply Chains Are Shortening, Then Twisting

One unexpected outcome of these shifts is how parts are now moving. After pandemic disruptions, automakers reduced long-distance dependency and are moving closer to their final markets. Mexico supplies North America. India feeds Southeast Asia, Africa, and the Middle East. Europe sources more within its own borders or nearby.

Despite these changes, nothing is fully local. Semiconductor shortages made that clear. A chip might be designed in the U.S., fabricated in Taiwan, packaged in Malaysia, and finally installed in a car in Slovakia. That level of complexity is no longer an exception but the baseline. Plants are planning buffer inventory again, and warehouses are quietly expanding with a focus less on cost minimization and more on resilience.

What This Means on the Ground

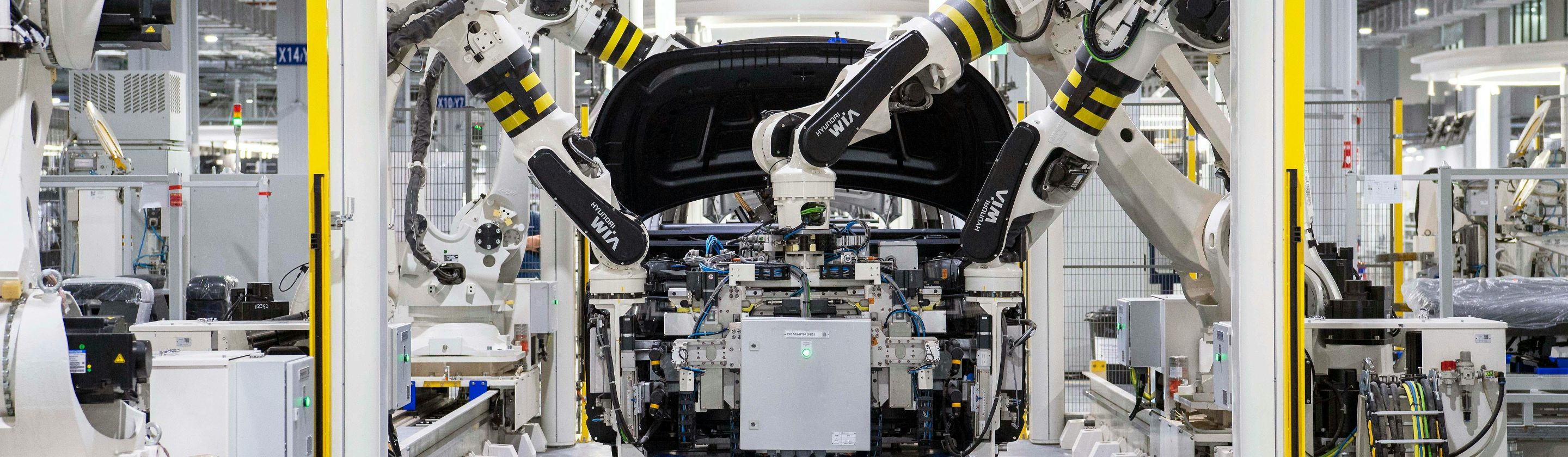

For workers, the shift is tangible and involves new training programs and new rules for high-voltage systems. In Mexico, EV lines are appearing next to gasoline ones. In India, automation is growing alongside manual processes rather than replacing them outright.

Consumers tend to feel the shift later. A familiar brand is suddenly built in a different country, with features that are quietly adjusted to match new production realities—sometimes a sturdier suspension here, simpler trim choices there.

Global auto production isn’t moving from one place to another so much as stretching outward, adapting, and occasionally doubling back. It’s messy, human, and still very much in motion.