10 Benefits Of Roadside Assistance & 10 Reasons It's A Rip-Off

Smart Safety Net Or Just Hype

Roadside problems can strike when you least expect them. While some drivers swear by roadside assistance, others say it’s just another money drain that you'll likely never even use. Ultimately, familiarizing yourself with the real ups and downs will change how you look at it. Here’s what you need to know before you make a decision, starting with the benefits.

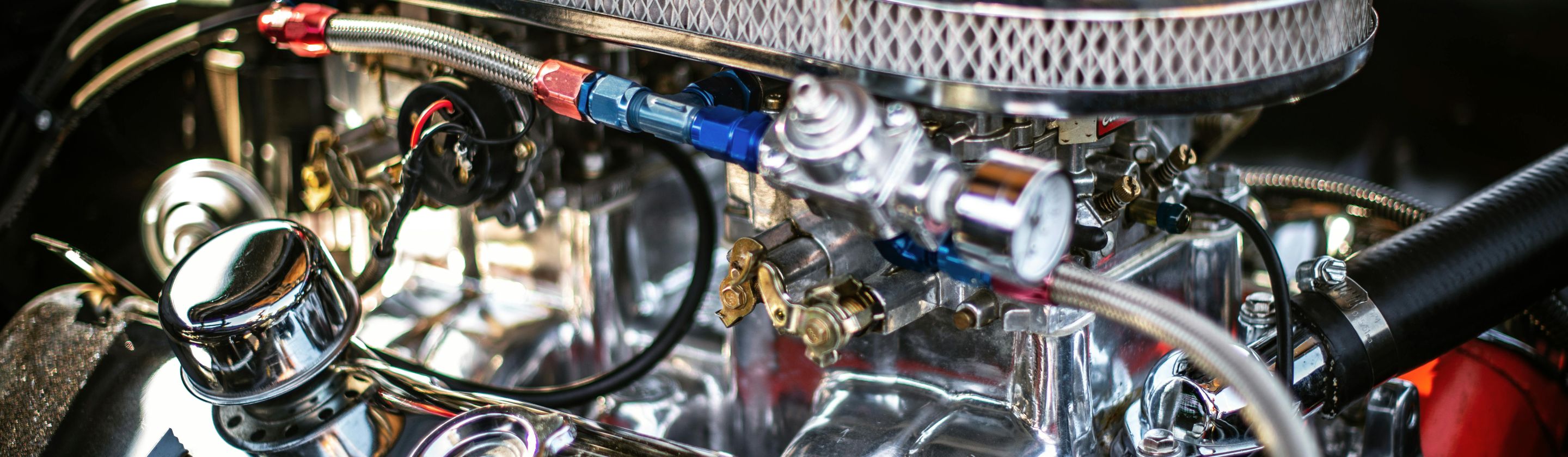

Zanelle Lofty-Eaton on Unsplash

Zanelle Lofty-Eaton on Unsplash

1. Peace Of Mind For Young Or Elderly Drivers

Confidence behind the wheel doesn’t always match reality. Teens panic, and seniors might hesitate to troubleshoot on their own. A roadside plan becomes the backup they didn’t know they needed, and it's only a phone call away.

2. Flat Tires Become A Minor Inconvenience

Tools in your trunk don't mean much if it's raining or you've never changed a tire. That's where roadside help wins. They come equipped and experienced. Instead of risking your fingers or your dignity, you get a smooth fix without lifting a jack.

3. Battery Jumps Without Calling A Friend

Mornings are tough enough. Add a dead battery, and suddenly, you’re stranded with no jumper cables in sight. Roadside assistance makes it easy—no awkward favors or panicked texts. Just a trained technician stepping in, and your engine humming again like nothing happened.

4. Locked Out Doesn’t Mean Stranded

You won’t believe how common it is to lock keys inside your vehicle. It even happens to delivery drivers and valets. Roadside programs know the drill. Their locksmiths work fast and without damage. You won’t have to worry about wire hangers or broken glass.

5. Towing Costs You Nothing Extra

Your transmission failing three blocks from a mechanic and then getting slapped with a $100 towing bill is not funny. With roadside assistance, that tow is likely covered. Limits vary, but within the plan’s mileage cap, it’s free. You get towed smartly, not expensively.

6. Fuel Delivery Keeps You Moving In A Pinch

Running out of gas doesn’t mean a long, humiliating trek down the highway. Roadside plans dispatch fuel right to your stranded vehicle and save precious time and energy. Instead of gambling with your last mile, you get a second chance and enough gas.

7. Coverage Applies Whether You Own Or Borrow The Car

It doesn’t matter if you’ve rented a car or borrowed your neighbor’s SUV; if your plan is driver-based, not vehicle-specific, roadside coverage still has your back. Consider it insurance that sticks to your license instead of your license plate. Wherever you go, help follows.

8. Plans Often Include Trip Interruption Coverage

Getting stuck far from home creates more than car problems and disrupts your entire trip. But here’s the kicker: some premium plans offer reimbursement for hotels, food, and more. It’s a travel buffer built right into your vehicle coverage.

9. Assistance Is Available Nationwide And Often Beyond

Road trips feel lighter when a backup travels with you. Roadside services extend across all 50 states, from Maine’s foggy highways to Arizona’s desert roads and sometimes into Canada and Mexico. No need to second-guess pit stops or border crossings anymore.

10. Digital Apps Make Requests Easier Than Ever

Gone are the days of calling and guessing your location. With digital apps from providers like AAA and Allstate, GPS pinpoints you when you request help. It’s like carrying a little rescue beacon in your pocket every time you drive.

However, not every promise turns into a real rescue. Sometimes, what looks like a safety net feels more like a trap. Let's talk about the side that doesn't get advertised.

1. You May Already Be Covered Elsewhere

Before signing anything, check your wallet. Many credit cards and new car warranties already include roadside assistance perks. Double-paying for something you already own? That’s money out the window. A quick review of your benefits could save a bundle instantly.

2. Response Times Can Be Disappointingly Long

Waiting for a tow truck feels like watching paint dry—painfully slow, especially during rush hour or holidays. Response time may even stretch over an hour. Sure, help eventually arrives, but the wait can turn a small inconvenience into a full-blown bad day.

3. Fine Print Can Limit What’s Covered

Hidden clauses lurk like potholes in many roadside contracts. Imagine not receiving help because lockout assistance is only available if your keys are visible. Rules like these can leave you stuck. Reading every tedious detail upfront beats arguing with customer service when stranded.

4. Monthly Costs Add Up Without Use

Paying $6 to $10 monthly sounds harmless until you realize you haven’t needed a jump or tow in two years. That’s over $100 gone for nothing. Some drivers end up funding years of coverage they barely remember signing up for.

5. Many Drivers Rarely Experience Breakdowns

Modern cars are tanks compared to decades past. Thanks to better engineering and diagnostics, the average driver might never need a tow in five years. Paying monthly for assistance you'll likely never use feels less like smart preparation and more like a quiet money leak.

Antoni Shkraba Studio on Pexels

Antoni Shkraba Studio on Pexels

6. DIY Emergency Kits Can Be Just As Effective

Smart drivers often build kits that rival basic roadside coverage. A few hundred dollars spent once beats years of subscription fees. In many cases, you can solve your own emergencies faster than waiting for a distant tow truck.

7. Inconsistent Quality From Contracted Providers

Not every roadside technician shows up like a hero. Many services subcontract local garages, and quality varies widely. Some tow operators act in a rush or lack proper tools. You’re rolling the dice with each call. One day, it’s professional help; the next, it's a headache.

8. Extra Charges For Towing Large Vehicles

Some roadside plans tack on "oversized vehicle" fees at the worst moment, right when you need a tow. Suddenly, your “covered” assistance costs $75 extra. Always check whether your beloved big rig actually fits under your policy’s umbrella.

9. Some Claims Get Rejected Due To Technicalities

One may call for help and get denied because a certain mechanical failure is not included or their situation is deemed “non-emergency.” Technicalities can wreck roadside promises. It's not rare, either. Always review conditions carefully or risk arguing the fine print.

10. Coverage Caps Can Mean Surprise Charges

Towed 11 miles instead of 10? Some plans start charging by the mile after surprisingly low limits. That “free” tow? It's not so free when the final invoice hits your inbox. Always ask upfront how far your tow allowance stretches.