To Lease or To Finance

Most people don’t have the money to outright buy their dream car, especially when most standard vehicles can cost anywhere from $20,000 to $60,000. Instead, you could choose to lease the car, where you’re essentially paying a monthly fee to borrow and use it. Or you could finance, where you take a loan to buy the car and pay it off in monthly installments. However, which option is the right choice?

1. Lower Payments

If your biggest goal is to save as much money as you can every month, then leasing is the way to go. Since you aren’t paying to own the car but simply borrow it, the monthly payments are often cheaper. That means the exact same vehicle is cheaper to lease than to finance.

2. Switching It Up

Plus, you’ll never get bored, as most leasing contracts offer flexibility! In fact, one man would switch up the car he borrowed every single week, allowing him to try out all sorts of models. This is a great perk for a car enthusiast who’s curious about multiple brands.

3. Keeping It Fresh

Even if you don’t want to switch up your car frequently, you can still change it every few years. That means when your 2025 model has a year on it, you can instead switch to 2026. This way, you’ll always be driving the newest model!

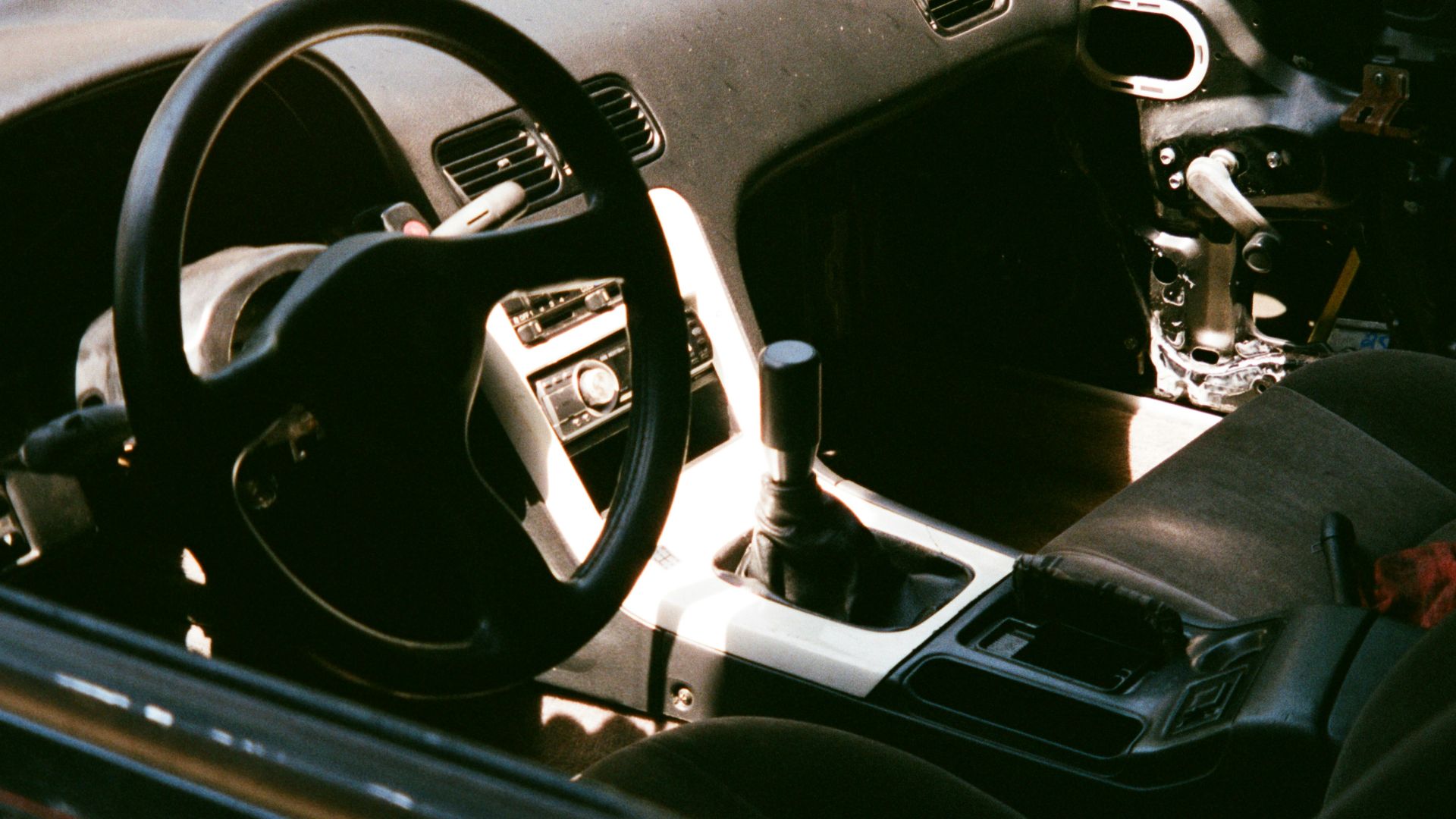

Swansway Motor Group on Unsplash

Swansway Motor Group on Unsplash

4. Warranty Coverage

A lot of lease agreements will last as long as the car’s warranty. This means you don’t have to worry about major repairs or degradation. This will also save you money in the long run, allowing you to instead focus on the fun of driving.

5. No Maintenance Worries

In fact, the leasing contracts often include maintenance as well. This adds up, as most new cars don’t require frequent repairs. But just in case something happens, and your car needs a tune-up, you can take solace in coverage.

6. Not Your Sale

If you own or finance a car, it’s up to you to figure out how to sell it when the time comes. But if you’re leasing, you simply return it to the lender. You don’t have to worry about selling it or negotiating a trade-in. You might even be able to buy it if that’s what you want.

7. Business Conscious

If you own a business or want to lease cars for your job, there are tax benefits to consider as well. Leasing is applicable as a tax write-off, if your car is used for work purposes that is. With that in mind, leasing is a great choice for entrepreneurs.

8. No Commitment

For some people, the thought of commitment is a scary one. Maybe you don’t know how long you’ll be in the country, or you’re not sure if driving is for you. Well, leasing is a great way to participate in the lifestyle without having to commit to owning a car for a decade or more.

9. Depreciation

A big fear for a lot of car owners is depreciation. Essentially, with time, the car loses its value and becomes trickier and less rewarding to sell. You don’t have to worry about these numbers when you’re leasing. Not your car, not your problem.

10. Expensive Cars

Leasing may be the only way for a lot of people to get their hands on expensive cars, whether that be a Jeep or a Mercedes-Benz. This can be a fun way to show off to friends, or just indulge the curiosity inside yourself. Plus, you’ll be sure to turn some heads driving down in your BMW.

Now that we talked about reasons to lease, here are 10 that you should finance instead.

1. Ownership

Unlike leasing, you’re not borrowing the car, as you technically own it. At least, you will own it once the payments are all made. Then you won’t have to worry about payments at all as the car will be totally yours. This might become an issue if you don’t want the car anymore; otherwise, it’s a perk!

2. Resale Value

When you do decide to get rid of the car, you can regain some of its value by selling it or trading it. On the flip side, with leasing, you’re just putting money in a pit and aren’t really getting anything out of it. But when you’re financing, you can sell the car afterward to make back some money.

3. No Lease-End Fees

Most leases come with lease-end fees, which may account for excess wear or tear. Additionally, they could have stringent rules regarding mileage and how the car must be driven. But with financing, you can drive as much as you want to, as the car is yours.

4. Long-Term Savings

When it comes to financing, you’re paying more money upfront and as a monthly payment. However, when you finish paying it off and choose to keep the car, then you’ll be saving money in the long run compared to leasing. Think of leasing as renting and financing as renting to own.

5. Customizability

When you finance a car, you essentially own it, which means you can do whatever you want. With leased cars, there are rules against painting or modifications. But with financing, you can change up your car’s appearance or upgrade it however you like. So go ahead and get those tinted windows or install that new sound system.

6. Unlimited Mileage

Financing means you don’t have to worry about mileage restrictions either. There are no penalties for driving a lot, which is a must-have feature for those who commute to work or work for ridesharing programs. Plus, you don’t have to report back to anyone when you decide to plan a road trip.

7. Financing Options

Financing also comes with a lot of flexibility. For instance, companies will offer promotions, such as 0% or low interest rates. With good credit, you can also increase your access to more perks and get a better deal.

8. Credit Building

Those car payments are also going to look good on your credit score. Paying off a loan helps to build long-term credit history, and if you stay timely, this can be a big boost. For a lot of people, loans like this are the best way to increase their creditworthiness.

9. Long-Term Access

After you finish a few years of paying off the car, it’s yours forever. This is a great option for someone who just wants a car to own for the long-term and doesn’t care about all the flashiness of new vehicles. Plus, you can give this car to your kid later, which is something you can do if you finance.

10. Flexible Insurance

When you’re financing a car, you’ll have access to more insurance options. Insurance can be a huge money pit when it comes to car ownership, and leasing agreements often require high coverage. However, financing is like owning a car, so you’ll get the needed flexibility when picking a plan.