GM Pulls Out of China: What It Means for Global Auto Manufacturing

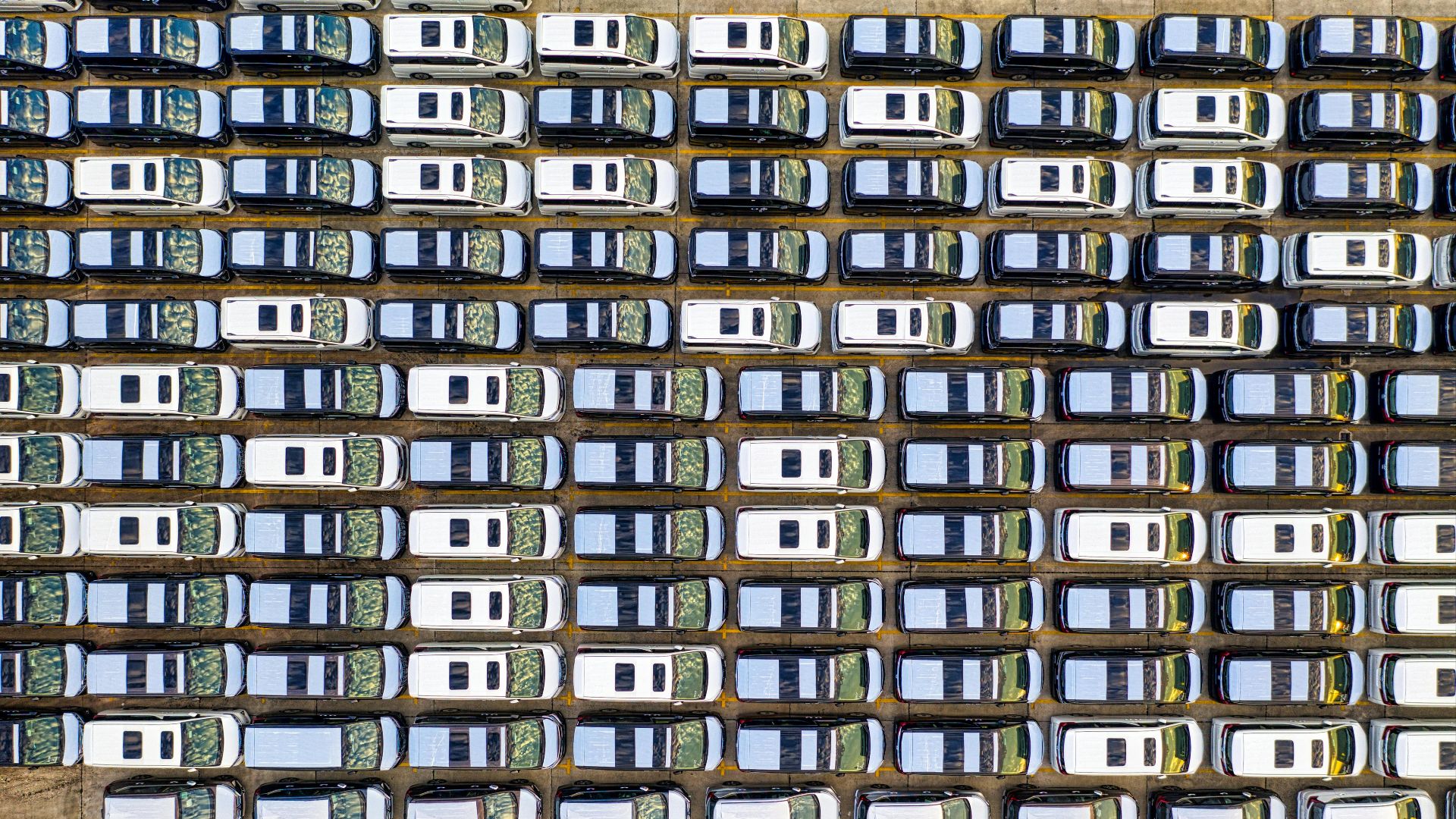

General Motors just told thousands of its suppliers to get out of China. They didn’t mean gradually, either. The deadline has been set for 2027. The directive started quietly in late 2024 but kicked into high gear this year as U.S.-China trade tensions escalated, and now one of Detroit's biggest automakers is essentially rewiring its entire supply chain. This isn't about moving a few factories or tweaking sourcing for one component. GM is asking suppliers to eliminate China from their sourcing playbook entirely—everything from lighting assemblies to electronics modules to basic hardware. The scale of it is staggering, and the ripple effects will reshape how cars get made globally for years to come.

It's Not Actually About Pulling Out of China

Here's where the headline gets misleading. GM isn't abandoning the Chinese market; what they're doing is limiting Chinese content in vehicles built in North America. The goal is supply chain resilience to better weather future geopolitical tensions when they flare up.

The initiative accelerated after China restricted exports of rare-earth-related auto parts in April and imposed further limits in October. Nothing focuses an automaker's mind quite like the threat of production lines grinding to a halt because a critical supplier got caught in a trade war crossfire. China also halted shipments from chipmaker Nexperia during an intellectual-property dispute, threatening production lines worldwide.

The irony is that decades ago, companies moved production to China precisely for resilience. Diversification, they called it. Not only were the costs lower, but the profits were bigger. Now they're learning that putting all their eggs in one basket has drawbacks.

The 2027 Deadline Is Ambitious to the Point of Absurdity

China has long dominated industries such as lighting, electronics, and tool-and-die manufacturing, making replacement suppliers hard to identify. You can't just snap your fingers and conjure up new factories in Mexico or Michigan.

A supplier that's been getting components from the same Chinese manufacturer for twenty years now needs to find someone else, negotiate contracts, test parts for quality, ramp up production, all while maintaining current deliveries so GM's assembly lines don't stop. And they have less than two years to do it.

GM CEO Mary Barra mentioned during an October conference call that the company has been working on supply chain resiliency for a few years, which suggests they're not going into this completely blind. That said, the automotive supply chain is one of the most complex in global manufacturing and disrupting that is like performing surgery on a moving car.

Other Automakers Are Watching Closely

GM isn't the only company nervous about Chinese supply chains, but they're the most aggressive about doing something. Other manufacturers have quietly been diversifying too, but without the hard deadlines and sweeping directives. They're watching to see if GM's gamble pays off or backfires spectacularly.

If GM pulls this off and ends up with a more stable, less vulnerable supply chain, competitors will scramble to copy their playbook. If it results in parts shortages, production delays, and skyrocketing costs, everyone else will thank GM for being the guinea pig and proceed more cautiously. Either way, the industry is heading in this direction. Automotive executives have grown weary of unstable trade dynamics between the U.S. and China, and nobody wants their production held hostage by the next round of tariff escalations.

The Costs Will Get Passed Down

Industry experts warn that replacing China's deeply integrated manufacturing network could take years and significantly raise costs. Parts made in China are cheap because China spent decades building manufacturing ecosystems with specialized suppliers, trained workers, and efficient logistics. You can’t replicate that overnight in Tennessee.

GM's global purchasing chief, Shilpan Amin, said the risk of supply disruptions has forced the automaker to move away from simply sourcing from the lowest-cost countries. Automakers will absorb some of the cost to stay competitive, at least initially, but eventually that hike will show up in MSRPs and option packages.

This Could Reshape Where Cars Are Built

GM's push could eventually reshape where and how North American vehicles are built. If suppliers are setting up new facilities closer to final assembly plants, that changes the geography of automotive manufacturing. It’ll mean more production in Mexico, more in the U.S., potentially more in Canada—creating jobs, investments, and a rewritten map of economic activity.

There's something almost circular about how the auto industry spent the last forty years globalizing, chasing efficiency and cost savings across borders. Now it's partially reversing course, trading some of that efficiency for security and predictability.

Whether we end up with a genuinely more resilient system or just a more expensive, slightly less efficient one remains to be seen, but GM's betting big that this shakeup is worth the cost.